CRM Implementation Best Practices for Distributors

Most CRM implementations in distribution fail because they don’t connect with the company’s enterprise resource planning (ERP) system. When CRM and ERP operate separately, customer and order records get duplicated across systems, quotes don’t match invoices, and dashboards show numbers that don’t add up with actual sales activity. Once that happens, leadership stops trusting the data, and the system quickly loses credibility.

A CRM only succeeds when it delivers immediate sales value. For distributors, that means clean integration, accurate account data, and prompts that drive timely follow-up. In this article, we outline practical steps for CRM implementation to build a system that delivers measurable revenue impact from day one.

Why CRM Implementations Fail (and How Distributors Can Avoid It)

CRM implementation failures come from the same set of issues: over-customization, weak data practices, poor alignment with ERP, and lack of adoption. Addressing these challenges turns what is often seen as a risky investment into a powerful sales advantage for distributors.

Common pitfalls with generic CRMs

Generic CRM systems track contacts and deals, but they miss the workflows that drive revenue in distribution. They are not built to connect with ERP data, capture reorder cycles, or highlight margin pressure. Instead of helping reps sell, they add extra steps that slow adoption and leave leaders with incomplete visibility.

- Disconnected from ERP: Without enterprise resource planning integration, reps can’t see orders, inventory, or fulfillment data inside the CRM. They still chase updates manually

- Too much admin, not enough sales focus: Generic tools bury reps in fields and screens that don’t help them follow up, reorder, or forecast

- Reporting that doesn’t fit distribution: Generic CRMs don’t provide distributor-specific alerts, like reorder prompts, price changes, or at-risk customer signals. Reps lose chances to act in time

- Over-customization risk: Fixing these gaps often means piling on custom work. That slows adoption, increases costs, and still doesn’t deliver the fit distributors need

Why distributors need a purpose-built approach

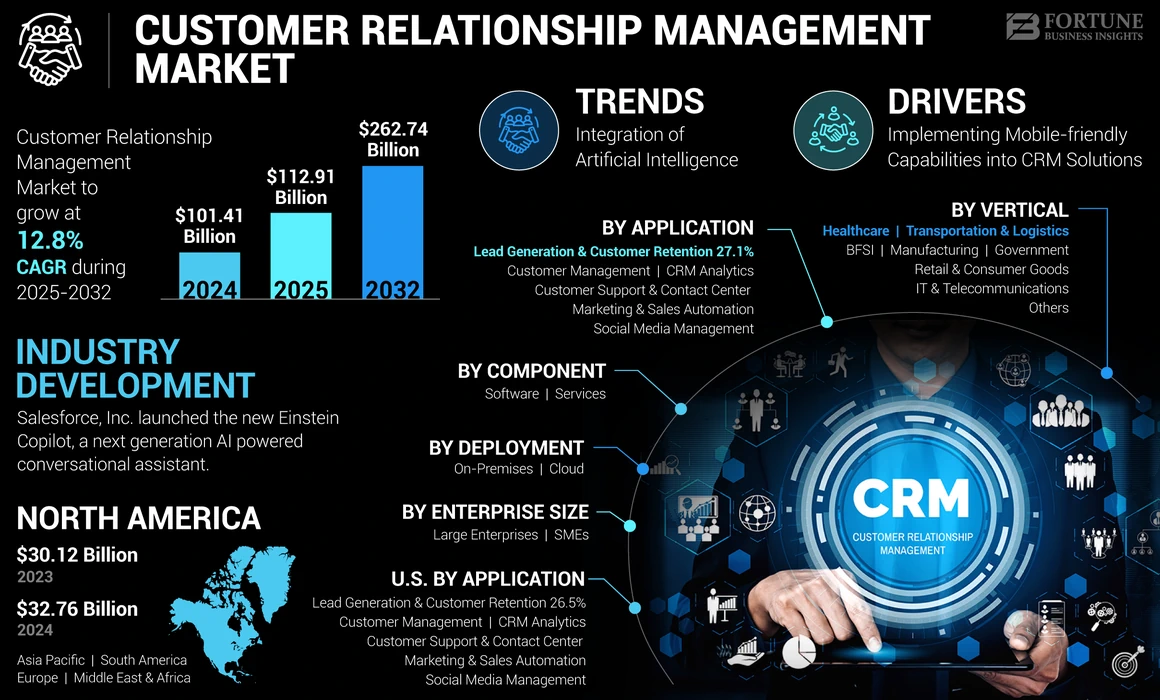

The global customer relationship management market is booming. It is projected to more than double from USD $112.91 billion in 2025 to USD $262.74 billion by 2032. [1] Much of that growth is driven by AI, predictive analytics, and mobile capabilities that promise faster selling and stronger customer retention.

However, for distributors, this growth in tools does not automatically deliver value. Generic CRMs often miss workflows like connecting reorder cycles to ERP data or tracking margin performance by territory.

A purpose-built CRM approach for distributors:

- Integrates ERP and CRM data deeply and natively, so order history and inventory flow automatically

- Embeds AI insights into real reorder and margin opportunities

- Delivers dashboards that track pipeline, territory health, and at-risk accounts

- Supports multichannel and multi-location selling without endless customization

(source: Fortune Business Insights)

To get those results, distributors need a structured plan. In the next steps, we look at how to align CRM goals with real sales challenges, prepare data, deliver quick wins, and measure revenue impact early.

Step 1: Align CRM Goals with Distributor Sales Challenges

The first step is to define what you want the customer relationship management system to achieve. Goals need to map directly to sales challenges like missed reorders, slipping margins, or unclear pipelines. With that focus, the CRM becomes a sales tool from day one.

Connecting CRM to revenue, not admin

The benefits of CRM for distributors are in capturing sales outcomes that move revenue. That means:

- More reorders captured when the system flags customers due to buy again

- Cross-sell and upsell opportunities surfaced from order history and buying patterns

- Margins protected by spotting accounts where discounting or price erosion cuts into profit

- Accurate forecasts built on real customer and order data

Using CRM + BI to prioritize follow-ups and visibility

Once revenue outcomes are clear, the next step is prioritization. White Cup CRM + BI brings it together so reps know exactly who to call, when to call, and what to pitch.

- White Cup CRM tracks every interaction and open opportunity

- White Cup BI layers in revenue, margin, and order cycle data, showing which customers are due to reorder or which accounts are slowing down

Plus, AI-powered recommendations prompt reps to follow up on at-risk deals or pitch higher-margin products right when it matters.

Step 2: Prepare Your Data for Actionable Insights

Distributors often delay CRM projects because they feel their data is not clean enough. But the truth is, you do not need perfect data to get started. What matters is making ERP information usable for sales and building confidence in the numbers as you go.

Turning ERP data into sales-ready intelligence

ERP systems track transactions: purchase orders, invoices, shipments, and inventory counts. That information keeps operations running, but it is not easy for sales teams to act on.

When ERP data flows into CRM and BI, it becomes sales-ready. Reps can see when a customer’s order cycle is coming up, which products are moving slowly, and where margins are slipping. Managers can use the same view to forecast with accuracy and coach reps on the right accounts to prioritize.

Ensuring clean, connected data from day one

We’re in the golden age of CRM for wholesale distribution, where customer data can finally work across ERP, eCommerce, and sales activity in real time. But that only happens if the foundation is clean. Start with the essentials: remove obvious duplicates, connect ERP and eCommerce records, and set clear ownership for updates. That gives every rep and manager a consistent customer record to work from.

It is important to note that data does not need to be absolutely perfect to deliver value. Having good-enough data is enough to see early wins, and improvements can be made as the system matures.

Step 3: Focus on Fast Wins, Not Long Rollouts

Distributors need visible results early. Fast wins prove the system drives sales and build confidence in adoption. That might look like flagging accounts that are 30 days past their usual reorder window, generating a territory pipeline report in under five minutes instead of waiting days, or giving reps mobile access to a customer’s full order history before a site visit. Quick gains like these show the system’s value long before a full rollout is complete.

Distributor-ready dashboards and quick adoption

Start with dashboards that answer the questions distributors ask every day: Which accounts are at risk? Which territories are underperforming? Where are margins slipping? Having these views ready at launch means managers see value right away, without waiting on custom builds or IT support.

Want a head start? White Cup CRM + BI comes with over 40 pre-built dashboards and 1,100+ reports designed for distributors. That means leaders don’t wait for custom builds; visibility into pipeline health, territory performance, and reorder cycles is ready on day one. Quick access to insights builds confidence in the system and elevates distribution sales across sales teams.

Training reps to sell more, faster

Reps don’t need training on menus and buttons. They need to see how CRM helps them win business. Training should show reps how to:

- Spot when a key account is overdue for a reorder

- Use customer history to pitch the right product mix

- Track open quotes and follow up before they go cold

- See territory coverage at a glance to avoid missed accounts

When training is tied to these everyday tasks, reps adopt faster because they see immediate payoff in orders, margins, and quota.

Step 4: Measure Revenue Impact Early and Often

Once the first wins are in place, the next step is to prove that the system is driving revenue. Measuring early builds confidence with leadership and keeps sales teams engaged. It also creates a baseline you can track as adoption grows.

Tracking sales performance and customer retention

Distributors should measure CRM success through numbers that reflect sales health. Focus on:

- Reorders captured on time show whether reps are acting before customers go elsewhere

- Cross-sell and upsell activity tracks how often reps expand wallet share inside existing accounts

- Margin protection highlights accounts where discounting or pricing leaks are eating into revenue

- Pipeline accuracy compares forecasted vs. actual close rates to see if deals are being tracked realistically

- Customer retention flags accounts with declining order frequency or shrinking spend

- Lifetime value trends monitor whether customers are becoming more profitable over time

Making CRM insights visible across the team

Revenue impact is only sustainable if insights are shared across the entire sales organization. A CRM that keeps data hidden in reports or buried in spreadsheets will never change behavior. Dashboards need to be simple enough so that:

- Reps see order history, open quotes, and reorder alerts so they know which accounts to call first

- Territory managers monitor coverage, stalled accounts, and margin performance by region

- Executives track pipeline accuracy, retention rates, and revenue trends to adjust strategy

When everyone works from the same data, reps know exactly which accounts to prioritize, managers act on early signs of risk, and leaders see whether sales activity is translating into revenue. That level of visibility secures adoption and turns insights into measurable growth.

Sources:

Fortune Business Insights. Smart Strategies, Giving Speed to your Growth Trajectory https://www.fortunebusinessinsights.com/customer-relationship-management-crm-market-103418